If your news feeds are anything like mine, I imagine you’ve seen plenty of articles about a “Great Resignation.” A list of some of these articles includes CNBC, Forbes, & Market Watch. The expressed views generally go as follows: “Covid-19 and its societal impacts have led to a huge wave of people leaving the workforce, which has caused labor shortages across America.” There ultimately must be some truth to that.

In 2020 many companies incentivized their older employees to take early retirement packages. There have also been many women leaving the workforce for child care reasons and, morbidly, a reduction of the working population due to pandemic death/illness.

These news stories of labor shortages also match my personal experiences when I’m going out. I have been going to many restaurants recently (clearly, I have some room for following my own advice), and I see help-wanted signs everywhere. I also notice much longer wait times for retailers compared to pre-pandemic, and it seems impossible to find people to help you in stores.

So my personal experiences match the news, and now everything is hunky-dory… so why am I writing this article? Well, I’ve recently read articles that express a slightly different view, which I am now looking to make sense of through writing.

A Great Reshuffle Explains Trends Better Than A Great Resignation

Recently LinkedIn’s CEO Ryan Roslanksy wrote a LinkedIn post (couldn’t have seen that one coming) where he detailed that there have been huge increases in the number of people switching jobs this year. He expanded on this post during a TIME interview.

“The global workforce is changing. I talked about how we see a 54% increase year over year in job transitions across the platform. When you look at Gen Z specifically, that number’s up 80% year over year, when you look at millennials that number is up 50% year over year, when you look at Gen X, that number’s up 31% year over year.”

Ryan Roslanksy, TIME Magazine

That is a lot of shuffling of jobs! This data intuitively makes a lot of sense to me. I haven’t changed jobs, but I have shuffled my way into being a part-time blogger. We have been in a pandemic now for more than a year and a half, giving lots of time to think about what makes us & our families happy.

Not only have we had more thinking time, but many of us also have more money in our pockets. There has been a boom in savings, a dramatic decrease in credit card indebtedness, student loan payment freezes, boosted unemployment benefits, and stimulus checks sent out to working folks. Pre-pandemic, around 70% of Americans had less than $1000 in savings. Well, take a look at how the pandemic affected savings rates.

American Personal Savings Rates

Americans have saved money en masse, and many folks are starting to taste a level of financial freedom they didn’t previously have. When the dependence on a paycheck from people’s employers is reduced, so is the reliance on the job.

Why sit around unhappy with lots of money in your pocket when you have the option to leave. In fact, interviewing for new job roles has never been this frictionless. In many white-collar jobs, you don’t even need to take off work to interview; all you have to do is block off time on your calendar for Zoom calls. You don’t have to go into a new office and meet interviewers, you don’t have to fly to a new location, and heck, you don’t even need to wear proper pants!

These factors are essential to consider when you hear of stats like 4.4 million voluntarily leaving jobs in September, 4.3 million leaving in August, 4 million leaving in July, and 3.8 million leaving in June (as tracked by the Bureau of Labor Statistics). I believe that many of these employees will be back in the labor force and are mainly in the process of reshuffling.

So what will some of the impacts be of this workplace shift? I’ll give you some of the effects that come to my mind.

A Great Reshuffle May Change The Relationship Trends Between Worker, Manager, & Capital

The growth of the American economy over the past 20 years has been a story of triumph. This can be shown in the growth of real GDP and real GDP per capita.

American Real GDP

American Real GDP per Capita

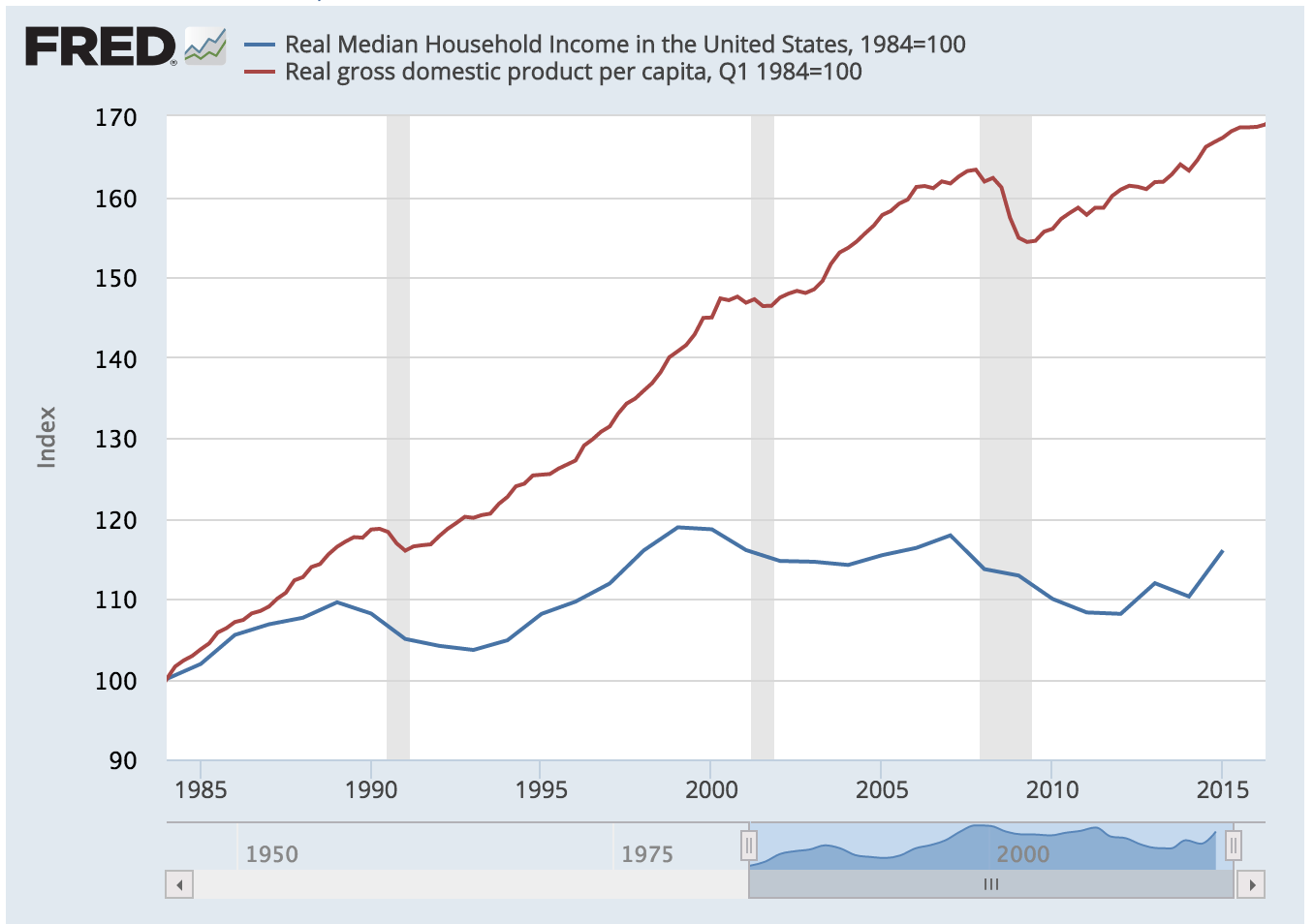

However, when you examine below the surface, you can discover trends between the average worker, management, and capital. Management and investors have been getting a growing share of GDP compared to workers. This is reflected in the stagnation of workers’ real median salary, significant increases in wages for management, and growth in profit margins for companies.

Real Median Household Income vs Real GDP per Household

Company Profit Margins

These trends have been going on for decades, and it would be unwise of me to act like I’m 100% sure of a reversal. I think it’s more likely that the forces of capitalism won’t allow for this trend to reverse. I will say that if this trend were to reverse the current labor movement, great reshuffling would serve as a great catalyst for it.

For stock investors, this is very important to keep in mind. We represent the capital in this relationship, even if we represent the worker in our jobs. So when we are looking for investments, it is vital to consider the impacts of labor on the profitability of our companies.

Here I’ll run through a very basic example by looking at the difference between Walmart and Google (Alphabet). Walmart has 2,300,000 employees, and Google has 150,000. Walmarts average salary looks to be around $30K, while Google’s is about $200K. This works out to be that Walmarts labor costs as a percent of their net profit is 530%, while Google’s is around 75%.

Labor cost increases can disproportionately affect Walmart as an investment compared to Google because Walmart’s labor costs compared to profits are very high. As such, the handling of labor relationships with an investment like Walmart is critical. A change in the relationship of workers, management, and capital would affect some companies’ profits more than others.

Having this knowledge by no means states to altogether avoid labor-intensive industries as investments. Other factors to consider for investment include the starting price paid, growth prospects, ability to pass along costs to customers, etc. Like anything else, this relationship is just another thing to consider.

Joining the Great Reshuffle can Increase Workplace Happiness

Alright, I’ll take my investor hat off and put my worker bee hat on. For all of us participating in the labor market, it is now a great time to assess what you’re looking for in a job. You likely have some extra cash in your pockets (not only from saving but from rising market values), and you’ve had some time to think about what your ideal working condition is. It is a great time to pursue what you want!

Many jobs are hiring due to employers’ workers shuffling around. There have been reports out that there are more job openings than people looking for jobs. Many employers are desperate, and you can use that to your advantage in applying for jobs you may not feel your qualified for. There is also added negotiating power for workers entering a new job or even for workers looking for a raise from their current employer.

It now looks like we have a society full of people discovering they are not passionate about their jobs and willing to branch out to new opportunities. This makes me optimistic about workplace happiness. We may be entering a period of broader happiness after we’ve all been whipsawed by the severe pandemic.

Make a plan, brush up that resume, and consider joining the reshuffle! I was right there alongside you shuffling, though my process ended with me creating this blog.

Inflation in Goods & Services May Remain Elevated due to Labor Costs

The last impact of the reshuffle I’ll talk about is the I-Word (inflation). I’m talking about this one last because I don’t really have a differentiated view. I’m not on the board of the Fed (shocking I know) and I clearly am not looking at all the data they are. However, I do take some issue with the view that inflation is definitely transitory.

I am of the view we don’t know how this reshuffle will workout and that there is a lot of uncertainty with where inflation will go next. What I do know is that in the future, when this period plays out, everyone will say they knew the outcome. Let me go on the record say that I am not sure what will happen. What I’ll now write on is an outcome that I believe is possible, maybe even probable, but in no way certain.

The period of people moving around jobs is relatively new and it is possible that this will be a long lasting change. It is more frictionless now to change jobs than it ever was in modern history, due to all of the new technologies that Covid-19 has forced us to use.

If this period continues, it will naturally lead to higher wages for the population as businesses continue to fight each other to attract talent. There is also a possibility that even with higher wages, labor shortages persist in certain industries that employees feel are unattractive. In that scenario, material shortages in those industries will follow. Following Economics 101, if supply decreases with persistent demand it will lead to price increases. I view this outcome as a double-edged sword scenario. I believe that is currently playing out real time, the main question is will it change or stay the same longer than expected.

This list of course is not comprehensive, I’m curious if you all think there are more implications of the Great Reshuffle. Feel free to comment your thoughts.